We regularly hear about how expensive renewables are and how Ontario’s electricity prices have risen because of them. The truth is, we are not Ontario and it is not 2009. Alberta is looking at solar development at the perfect time – we need to thank the Germans, Californians, Ontarians, Texans, the Chinese, in fact the majority of the world – we are very late to this game and the world has reduced solar costs to our benefit. The world solar market has grown capacity, scaled up manufacturing and brought solar and wind prices to lows that can compete with traditional generation. In fact, more solar was installed in the first half of 2015 in the US than any other generation type, including natural gas and wind.

Firstly, there is no question that Ontario power bills have increased, but what is the cause of these increases?

The increases on your electrical bill show up in the form of a “Global Adjustment Charge“. Renewables in fact are a minority share of the Global Adjustment as shown in the following graph taken from the Ontario system operator’s September report (http://www.ieso.ca/imoweb/

As can be seen, solar and wind only represent about ~1/3 of the total Global Adjustment Charges.

You can read the auditor general’s recent report for more details on the cause of rising electricity costs here (http://www.auditor.on.ca/en/

- Lack of competitive procurement for solar and wind – “We found that the prices under Ontario’s guaranteed-price renewable program were still double the market price for wind and three and a half times the market price for solar energy in 2014” (page 214) The early days of the Ontario FIT program had even more inflated prices.

- Lower Mattagami Hydro (438MW) project cost increases leading to $135/MWh hydro power (compared to $56/MWh for comparable Canadian projects)

- Conversion of Thunder Bay coal plant to biomass leading to $1600/MWh biomass (25x higher than other biomass in Ontario)

- Costly cancellation of gas plants costing consumers about ~$1 billion

- $2.3Billion conservation program that tapers demand during surplus power generation times leading to expensive curtailments and exports. Conservation during times of peak demand could have had the opposite cost effect.

- Ongoing capacity and reliability issues

No question there was a number of problems with Ontario’s Green Energy Act that led to higher than necessary impacts to consumers. Already though, Alberta looks to be setting itself apart:

- Competitive procurement – the climate change panel has recommended a competitive procurement process for large transmission connected renewables (in line with CanSIA and CanWEA’s recommendations to the panel). Ontario’s lack of competitive procurement is one of the key reasons that they have paid and continue to pay such high prices for wind and solar.

- Recommendation by the climate change panel to incentivize renewables with long term Renewable Energy Certificate or REC purchase agreements instead of Power purchase agreements for the energy (or Feed-in-Tariff FIT contracts) – If the government in fact takes this path as recommended by the climate change panel, a REC purchase should, in part, help to maintain some of the benefits of the energy only market providing a market based incentive for generators to match demand. Solar, as a daytime energy producer, aligns with daytime demand and so receives a significant premium in the energy only market.

- Alberta has a greater industrial (24×7) weighted demand curve with less swing between minimums and maximums. This should in particular benefit more wind integration with night time, off-peak demand still being relatively high compared to day-time demand. Alberta’s demand swung from a low of 7,162 MW to a high of 11,229 MW in 2014 (a 36% differential). Ontario, for contrast, saw demand swings of under 10,719 MW to a high of 22,774 MW (a 53% differential)!

- Alberta has better wind and solar resources than Ontario therefore requiring lower support levels to drive investment.

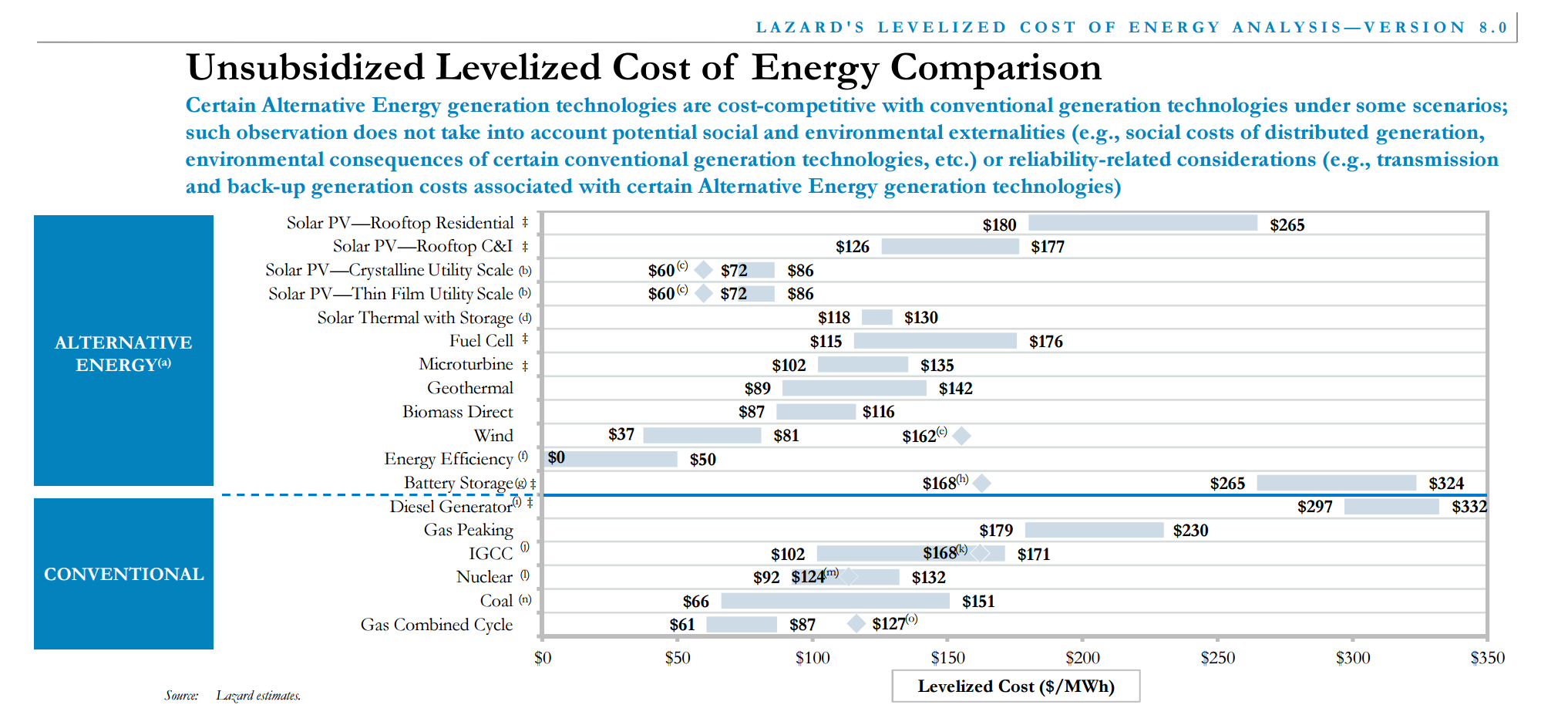

- Prices have dropped – cost of wind and solar in particular have dropped significantly since Ontario began its journey into renewables. Solar is winning competitively procured PPAs at less than $70US/MWh (without incentives). A good price for a daytime generator and an excellent price for a generator that aligns perfectly with peak air conditioning loads. Air conditioning loads often drive market prices to their maximum at the same time that thermal generators need to limit their output due to the excessive heat. LCOEs of wind and solar are in fact comparable with fossil fuel generators as shown in this report from Lazard in 2014:

Note that this is in US$ and solar numbers assume SW US installation where resource is slightly better than Alberta.

SkyFire Energy has worked hard to grow the solar industry in Alberta for almost 15 years now. We have worked hard to reduce our pricing and improve system design such that without any subsidies, systems like this 2MW one east of Calgary are installed simply because the economics work. While the economics of solar on the retail side of the meter under Alberta’s Micro-Generation Regulation make sense today, the returns are longer term and require an outlook (10+ years) that is too long for most. For large scale solar development to support a coal phase out, solar projects need revenue certainty and higher returns. We fully support Alberta’s phase out of coal generation and are excited about the transition to renewable energy in Alberta. Lets make sure that we make this transition in a manner that provides for a stable renewable energy industry at the lowest energy costs to consumers. Our business is now tied to government policy – we have every desire to make sure that this policy is done right and in a way that is sustainable for our industry and consumers.

Alberta, we are not Ontario and let’s keep it that way.