Concerns with climate change quickly morphed into a climate emergency in 2019 and the likelihood that these growing concerns are going to diminish or vanish altogether appears unrealistic at best. One could likely surmise then that the new Federal Carbon Levy (or some form of) which was introduced in Saskatchewan in 2019 and in Alberta on January 1, 2020 (after Alberta eliminated its carbon levy as of May 30, 2019), is here to stay (note that British Columbia has had a Carbon Tax since the Gordon Campbell led Liberals introduced it in 2008).

A carbon tax is perhaps best defined as a form of pollution tax and is also an indirect tax — a tax on a transaction—as opposed to a direct tax, which taxes income. Economists refer to carbon taxes as a “price instrument” since it sets a price for carbon dioxide emissions. Regardless of your individual position with respect to taxing carbon, the reality is that the world shifted significantly in 2019 and is unlikely to return to what was.

Interestingly, very few are aware (including Albertans) that Alberta was the first jurisdiction in North America to price carbon (via the Climate Change and Emissions Management Act). One of the first actions taken under this legislation was to develop a mandatory reporting program for large emitters in Alberta. In March 2007, Alberta passed Specified Gas Emitters Regulation. The first compliance cycle was from July 1st to December 31, 2007.

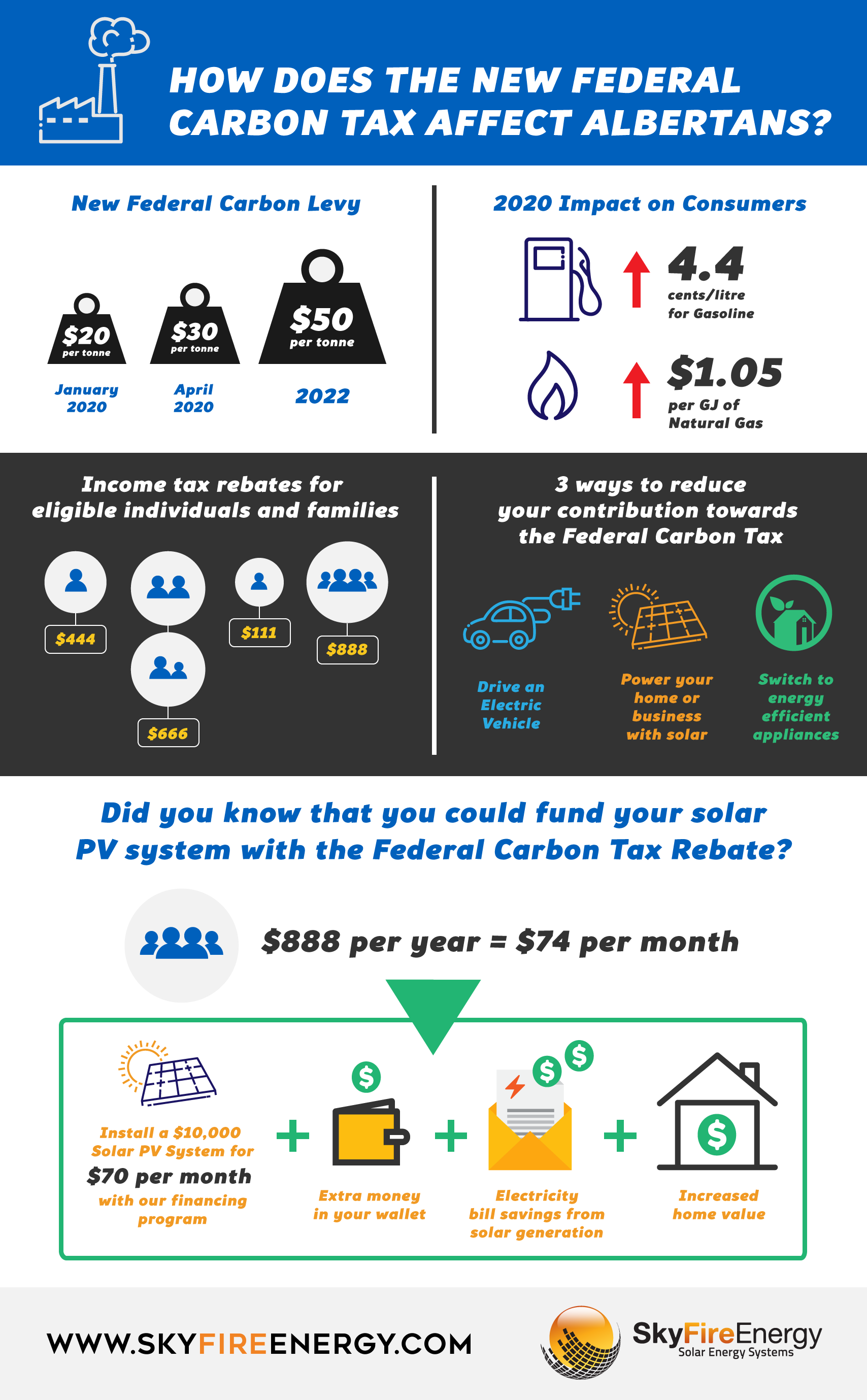

While one can disagree with pricing pollution in this manner and of the efficacy of doing so, the reality is the reality. Details of the federal carbon pollution pricing system for Alberta and Saskatchewan include:

Alberta

- Implemented, in part, in Alberta on January 1, 2020

- Carbon pollution price of $20 per tonne of carbon dioxide equivalent (CO2e)

- The bulk of the direct proceeds from the federal fuel charge in Alberta will be returned directly to eligible individuals and families residing in Alberta through Climate Action Incentive payments, starting in early 2020, through 2019 personal income tax returns as follows:

| Carbon pollution price* | 2020** ($20/tonne) | 2021 ($40/tonne) | 2022 ($50/tonne) |

|---|---|---|---|

| Single adult, or first adult in a couple | $444 | $496 | $600 |

| Second adult in a couple, or first child of a single parent | $222 | $248 | $300 |

| Each child under 18 (starting with the second child for single parents) | $111 | $124 | $150 |

| Baseline amount for a family of four | $880 | $992 | $1,200 |

*As of April 1 of each year.

** Three months (Jan-Mar 2020) price of $20 and Apr 2020-Mar 2021) with a price of $30.

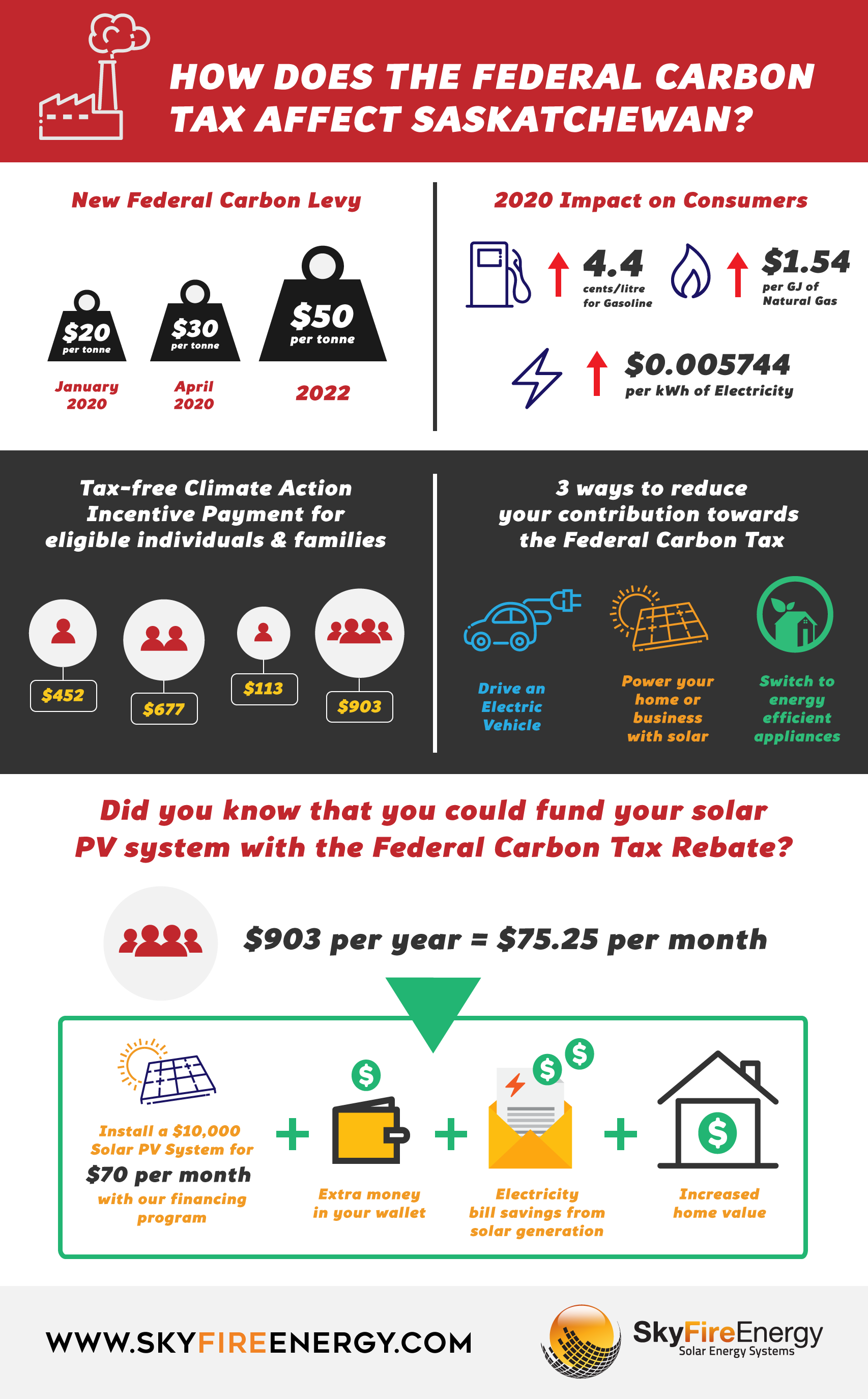

Saskatchewan

- Implemented, in part, on January 1, 2019

- Applies to electricity generation and natural gas transmission pipelines

- The Saskatchewan program covers facilities from those sectors that emit 50,000 tonnes of carbon dioxide equivalent (CO2e) per year or more

- Individuals in Saskatchewan will receive a tax-free Climate Action Incentive payment calculated as follows:

| Carbon pollution price | 2020 | 2021 | 2022 |

|---|---|---|---|

| First adult | $452 | $596 | $731 |

| Spouse | $225 | $297 | $364 |

| Child | $113 | $148 | $182 |

| Baseline amount for a family of four | $903 | $1,189 | $1,459 |

With a range of $880 to $1,459 per year for a family of four between 2020 and 2022, a significant amount of the carbon tax collected by the Federal government will be refunded to households in the coming years. A carbon tax has been devised and implemented in an effort to encourage the reduced use of hydrocarbon fuels. In its present form, the carbon tax is technology agnostic. While there is a disincentive to consume hydrocarbons, there are no specific programs or incentives to support a specific technological solution (as there was with the former Alberta Residential or Commercial Solar Program). While not a technological solution, avoidance is generally the most effective approach (e.g. consume less of any of gasoline, diesel, electricity) while still receiving a rebate.

For those seeking a proactive approach to the carbon tax and increasing prices at the fuel pump and on their electricity bills, options certainly do exist in 2020. In fact, the options either currently or available within the calendar year are very exciting. Electric Vehicles (EV) such as the Tesla line-up (including the recently unveiled Cybertruck which has been getting great reviews from many that I speak to) or Plug-In Hybrid Electric Vehicles (PHEV) have proven their efficiency and effectiveness and one could argue are becoming mainstream (even in our relatively harsh Canadian winter). While internal combustion engines (ICE) have been the norm for generations, there are plenty of reasons to expect that the domination of ICE is coming to an end with most major auto manufacturers ramping up their EV and PHEV options in 2020 (which in 2020 will include the 2021 Toyota Rav 4 Prime a vehicle that I am particularly excited for).

With the above being said, one might also question whether it makes sense to “fuel” your EV or PHEV with energy from a fossil-fuel dominated electricity grid that is still subject to carbon taxes for each unit of energy consumed? Perhaps not surprisingly, we think not.

There are plenty of reasons to consider a solar photovoltaic (PV) system to generate the equivalent household energy that you consume on an annual basis (i.e. kWh/year) from solar PV to be sure (think ecological, social and economic sustainability). Of course, the ability to fully offset your annual consumption (i.e. net zero on an annual basis) would be subject to the generating potential of your home which is based on a number of factors. Please request a complimentary solar consultation by one of SkyFire’s Solar Specialists for a better understanding of your solar PV potential.

- Assuming that your home/household consumes 7,500 kWh/year for everything from lighting and furnace blower to the television, computer(s) and charging of mobile devices and that you add an EV (e.g. 15,000 km @ 20.9 kWh/100km1 = ~3,100 kWh/year), your annual household consumption would be ~10,600 kWh. While not every home can generate 10,600 kWh of energy from solar PV, many can with no or very limited upgrades or alterations.

By leveraging the federal rebates of $880 to $1,459 per year in Alberta and Saskatchewan (expected to increase further beyond 2022 with global pressure to reduce greenhouse gas emissions) you will be avoiding a significant percentage of the carbon tax that you are otherwise paying. As an individual, business, institution or municipality you do have an exposure to rising carbon taxes. A solar PV system transforms a monthly payment to your utility or fuel provider that you are already incurring into an investment into an asset. You OWN your production. You HEDGE against future price increases and taxes and remove or reduce this uncertainty, a retirement savings plan of sorts.

Concerned about the upfront cost to install a solar PV system? That’s fair, the average residential system is ~$15,000 (not a small sum of $ for most households) and not everyone has those funds available. SkyFire has financing options available as low as $70/month which allow you to use the monthly savings from your electric bill (and gasoline/diesel savings in the case of an EV or PHEV), along with the Federal incentive payments to cash flow the system with little or no upfront cost.

Solar PV has never been more affordable and has never made more sense than it does in 2020. Few of us are happy about the ever-increasing taxes and rate increases, so why not instead choose to produce your own energy with a rooftop or ground-mounted solar PV system? The answer is increasingly clear, solar PV, generated at the source of consumption makes sense. Not just from a carbon pollution/environmental sustainability perspective – without question from an economic sustainability perspective as well.

Contact SkyFire today for your complimentary consultation with Western Canada’s most qualified and experienced solar PV installer!

- [maxbutton id=”1″ ]1 Assumes Tesla Model 3 Long Range AWD. The stated value (i.e. 28 kWh/100 mi) has been adjusted for the colder Canadian climate using a 20% adder.

Author: Greg Sauer, MEDes., VP Sales, SkyFire Energy